Updating bank feeds every 90 days

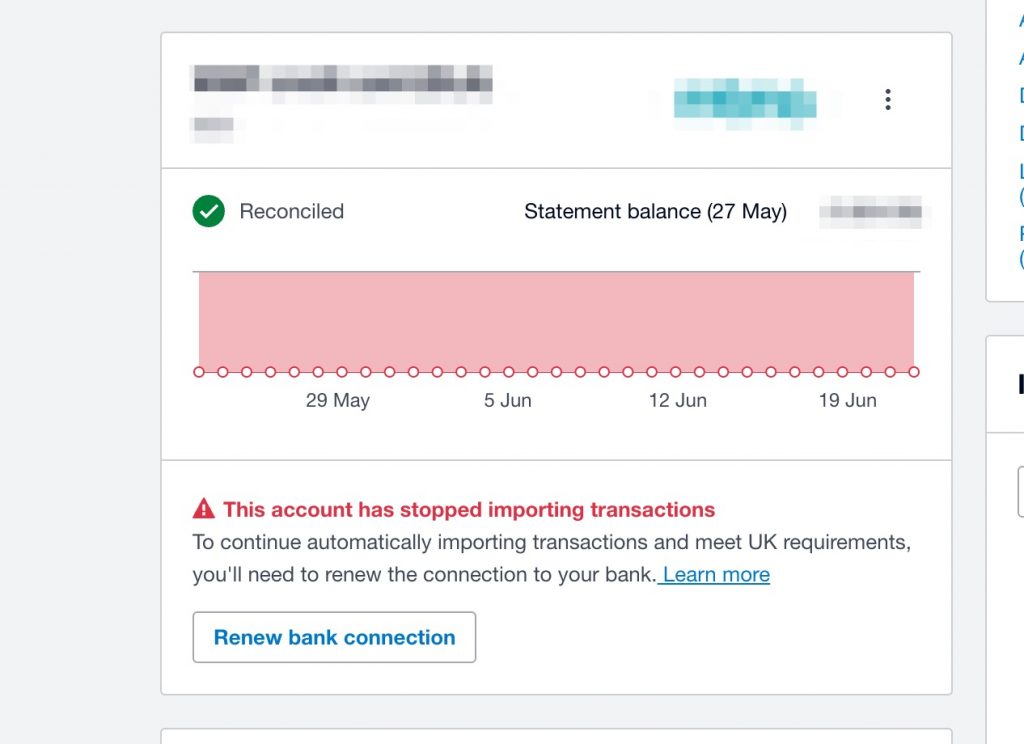

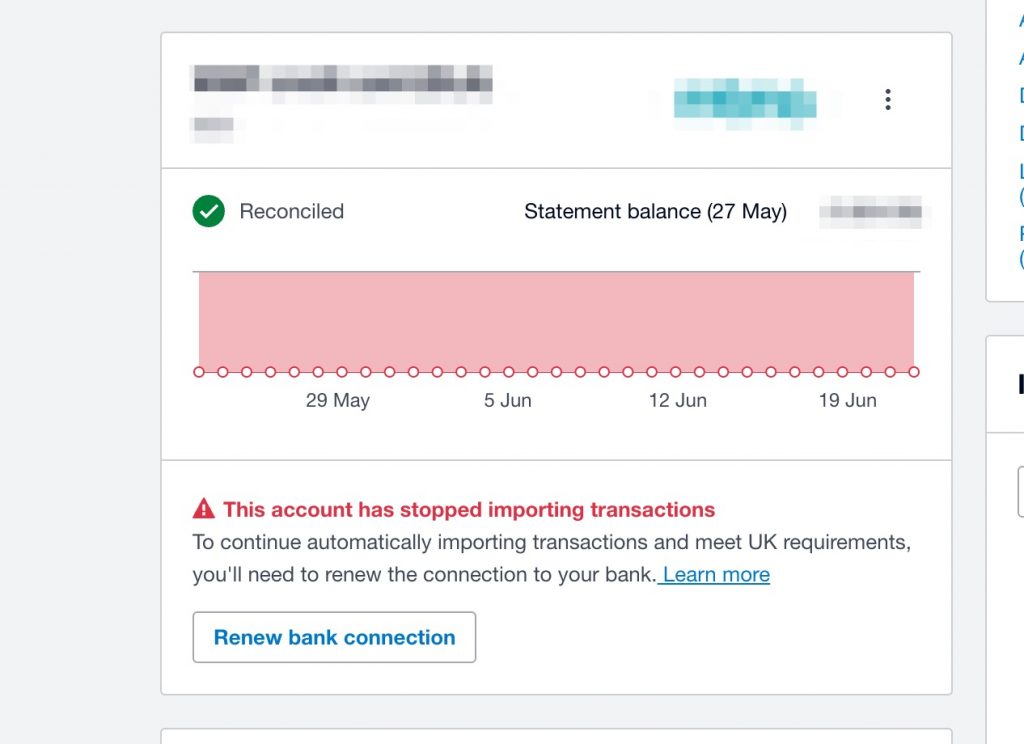

Please log into Xero and renew any bank feeds you have set up. You should see the option to update the feed on any accounts that need it.

Please note, if you use Starling bank, you’ll need to update the bank feed in the Starling App, not in Xero!

Why do I need to do this?

As part of new rules around open banking, you will have to log into Xero and update your bank feeds every 90 days. Depending on the bank you use, you may get a reminder to do this (Starling for example will notify you in App, which is where you can make the update).

If we spot that you need to update your feeds, we’ll notify you by SMS (text message). Please act on this quickly.

If you don’t update the feed before the feed is severed, then bank transactions will be missed and this can cause issues further down the line, with missed transactions and or the need to request bank statements for the whole year.

Here is the text from Xero about why you need to renew every 90 days:

Authenticating your bank feed

When you connect a new bank feed or change your existing bank feed connection, as part of the new requirements, your consent will last for 90 days. After 90 days, you’ll need to re-authenticate your bank connection. Xero will remind you when you need to do this – it’s as simple as re-entering your online banking credentials. Whilst it’s a little extra admin, this is a new standard under Open Banking.

If you don’t re-authenticate my bank feed after 90 days, you can re-authenticate your bank feed at a later date. You’ll just need to make sure you import historical transactions back to the date your bank feed stopped importing transactions so there isn’t a gap. You can only import 90 days of historical transactions when re-authenticating your bank feed. If you need more historic data you’ll need to manually import transactions into Xero.

Recent Comments