VAT and VAT registration

These videos will help you understand a VAT registration and how to do your book keeping once you are VAT registered:

Understanding the implications of being VAT registered:

- Create a sales invoice for any sales or work you do

- Watch: this video takes you through the process of creating a sales invoice in Xero: https://www.loom.com/share/9df8d9e99de743209fc266a39adf5516

- Read: http://www.loveaccountancy.co.uk/how-to-create-a-sales-invoice-in-xero/ for guidance on how to create an invoice – this is a useful guide when used in conjunction with the video above

- Process any purchase invoices or receipts as bills – this is a similar process to raising sales invoices. Remember you can attached scanned copies of any invoices or receipts received – we recommend doing this for ease of review and as evidence

- Watch: https://www.loom.com/share/9227978d4ea24adfb7e0c6ae4e622587 – this video takes you through the process of inputting a purchase invoice into Xero.

- Read: http://www.loveaccountancy.co.uk/how-to-process-a-purchase-invoices-bill-into-xero/ on how to process bills (this is a good summary guide to reference after watching the video above.

- If you have expenses that you paid for out of your own pocket (cash or personal bank account), mark these bills off as paid to the “Director’s Loan Account” if you are trading as a Limited Company or the “Capital Introduced” account if you are trading as a sole trader or partnership.

- Match bank receipts and payments with sales invoices and purchase bills. Create new transactions/transfers if necessary.

- See http://www.loveaccountancy.co.uk/how-to-reconcile-the-bank-in-xero/ on how to reconcile the bank

- If you’ve bought something using the business money that is personal in nature, you can reconcile this to the “Director’s Loan Account” if you are trading as a Limited Company or the “Drawings” account if you are trading as a sole trader or partnership.

Things to think about before your year end… These may help reduce tax

The best thing you can do is book a meeting with us as early as possible before your year end: chat.loveaccountancy.co.uk

- Making a larger pension contribution

- Paying into a company pension is a tax efficient way of putting money away for your future. The true cost to putting £10,000 into a pension is currently £8,100.

- Buy any large assets before year end

- Have all director expenses/mileage been put through Xero

- Do the statement balances on the bank accounts on Xero match your bank balances?

- Review salaries and bonuses – year end is a good time to declare bonuses to help reduce tax bills

- Consider R&D – have you taken on any eligible research and development projects in the year that could receive accelerated tax relief.

- Ensure your sales ledger is up to date and overdue invoices are chased. Love Accountancy can help you with this if necessary.

Help us to help you

- Help us get your accounts completed earlier by making sure Xero is as up to date as possible now, rather than later…

Smaller considerations:

- Staff events – each year a company can pay for annual staff events up to £150 (including VAT) per guest which is allowable for Corporation Tax relief. The rules are that all members of the company must be invited and a spouse or partner can attend provided the cost for the couple does not exceed £300 (including VAT). It will be tax free provided the limit is not exceeded, if it does the whole cost is taxable, not just the excess. This is not an allowance, you must include the actual cost of the event and have receipts to support this.

- Stock up on office supplies – for example printer cartridges, paper, stationery or other general office supplies.

- Consider trivial benefits for employees and directors – £50 limit : https://www.gov.uk/expenses-and-benefits-trivial-benefits – remember these must not be a “reward” or be considered contractual in nature

Things for Love Accountancy to consider: [LINK TO INTERNAL HUB]

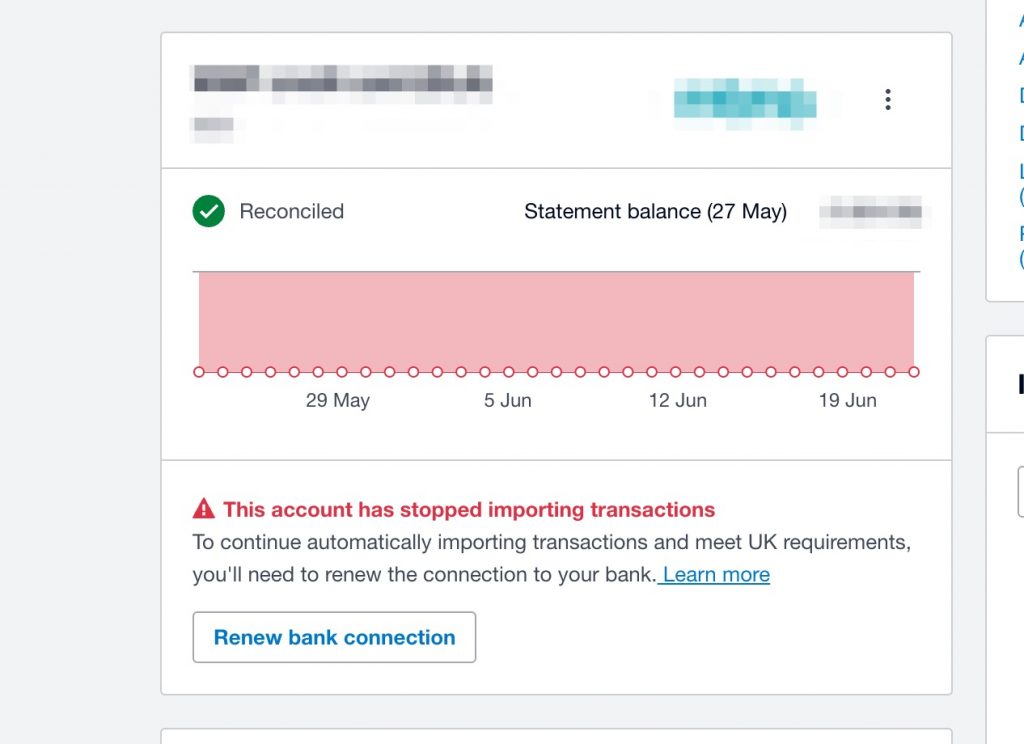

Updating bank feeds every 90 days

Please log into Xero and renew any bank feeds you have set up. You should see the option to update the feed on any accounts that need it.

Please note, if you use Starling bank, you’ll need to update the bank feed in the Starling App, not in Xero!

Why do I need to do this?

As part of new rules around open banking, you will have to log into Xero and update your bank feeds every 90 days. Depending on the bank you use, you may get a reminder to do this (Starling for example will notify you in App, which is where you can make the update).

If we spot that you need to update your feeds, we’ll notify you by SMS (text message). Please act on this quickly.

If you don’t update the feed before the feed is severed, then bank transactions will be missed and this can cause issues further down the line, with missed transactions and or the need to request bank statements for the whole year.

Here is the text from Xero about why you need to renew every 90 days:

Authenticating your bank feed

When you connect a new bank feed or change your existing bank feed connection, as part of the new requirements, your consent will last for 90 days. After 90 days, you’ll need to re-authenticate your bank connection. Xero will remind you when you need to do this – it’s as simple as re-entering your online banking credentials. Whilst it’s a little extra admin, this is a new standard under Open Banking.

If you don’t re-authenticate my bank feed after 90 days, you can re-authenticate your bank feed at a later date. You’ll just need to make sure you import historical transactions back to the date your bank feed stopped importing transactions so there isn’t a gap. You can only import 90 days of historical transactions when re-authenticating your bank feed. If you need more historic data you’ll need to manually import transactions into Xero.

- The full purchase amount can be written off against tax:

- Only if the car is bought by the company and is new (so, not leased or second hand).

- Financed purchases are OK, so long as the company owns the vehicle on their balance sheet.

- If the car cost £50,000 – this would be written off against tax, saving approx. £9,500

- Although, if the car is sold at a later date, tax on the sale value will be due

- Only if the car is bought by the company and is new (so, not leased or second hand).

- Benefit in Kind charge is 1% for 2021/22, 2% for 2022/23 and so on

- On a £50,000 car this would be £500

- Tax charge would therefore be:

- Basic rate tax rate: £100

- Higher rate tax rate: £200

If you’re thinking about making R&D tax credit claims, here’s what you need to know about the process. (more…)

Here are a couple of videos to help make sure you set up Todoist notifications effectively:

The basics:

Adjustments to notification settings:

Here’s a quick summary of what support is being offered to retail, hospitality and leisure businesses:

- The grant will be based on the rateable value of the property on the first full day of restrictions.

- If your business has a property with a rateable value of £15,000 or less, you may be eligible for a cash grant of £1,334 for each 28-day qualifying restrictions period.

- If your business has a property with a rateable value over £15,000 and less than £51,000, you may be eligible for a cash grant of £2,000 for each 28-day qualifying restrictions period.

- If your business has a property with a rateable value of £51,000 or above, you may be eligible for a cash grant of £3,000 for each 28-day qualifying restrictions period.

The grants are per property and administered by local authorities in England. If a client is based in Scotland, Wales or Northern Ireland you should check with the relevant authority to check the available support.

Central Government have also made additional funds available to local authorities to make discretionary payments to affected businesses in their area. You should check with the relevant authority to see what support might be available to your clients.

Below is a snippet of text provided by HMRC. Please speak to us before making a claim, as the eligibility has changed considerably from the first two grants.

Further reading and source: https://www.gov.uk/government/news/furlough-scheme-extended-and-further-economic-support-announced

Businesses required to close:

Restaurants, bars and pubs will be required to close but can continue to offer takeaway services. In addition, the following businesses will be required to close:

- all non-essential retail (clothing, electronics, betting, tobacco and vape shops, betting shops, tailors, car washes, vehicle showrooms and travel agents)

- indoor and outdoor leisure facilities (gyms, swimming pools, gold courses, dance studios, shooting ranges and stables/riding centres)

- entertainment venues (theatres, cinemas, bingo halls, casinos, zoos and animal attractions)

- personal care facilities (hair, beauty and nail salons, tattoo parlours, spas, massage parlours, non-medical acupuncture and tanning salons)

Non-essential businesses can continue to offer delivery and click and collect services.

Recent Comments