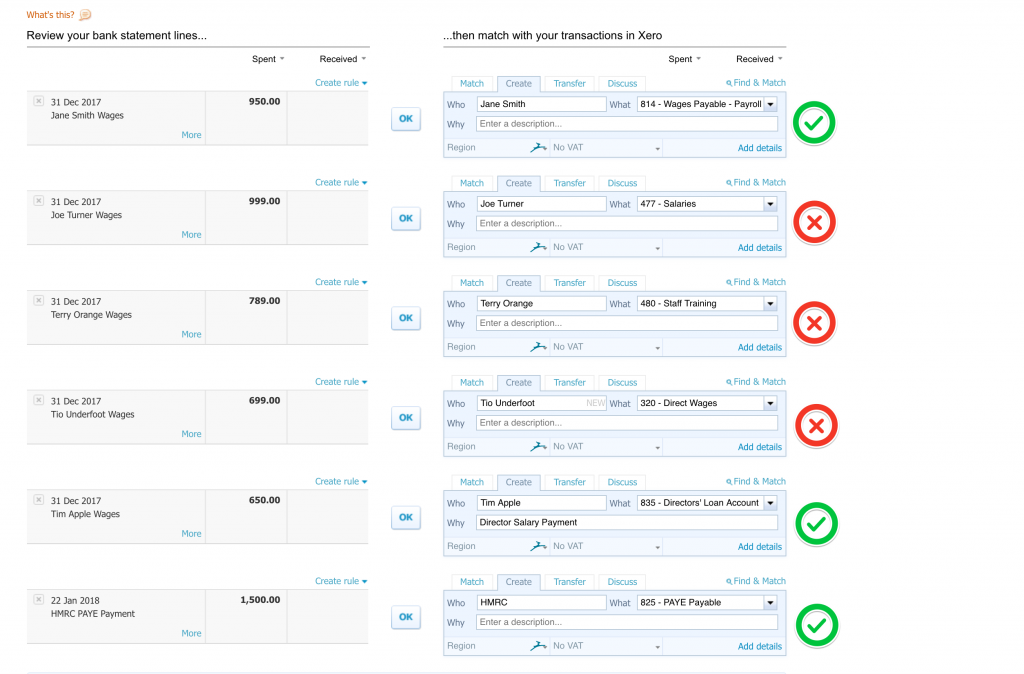

When reconciling wages payments in Xero, you should always post wages paid to the “814 – Wages Payable” code. It should never be posted to an account starting 3xx or 4xx.

HMRC PAYE payments should go to “825 – PAYE payable”.

So in short, any payments relating to payroll should be coded to an account in starting 8xx.

See below for examples:

If you post transaction to a 3xx or 4xx account code, there’s the risk of doubling up the expense (as Love Accountancy will have already posted a wages journal).

Let us know if you have any queries. Our contact details are in the footer.