- First Published: 23rd March 11:45

Last Updated: See below

As we get answers to questions (or have new advice), we’ll add them here and send out a WhatsApp broadcast, so we can help as many people as possible. Follow this link to join the broadcast list: http://www.loveaccountancy.co.uk/how-to-get-added-to-our-whatsapp-broadcasts/

Updates:

2 June 2020

New updates to the furlough scheme – here

26th March 20:30

Self Employment summary – added to the self employed section below

Watch Martin Lewis on ITV at 20:30

26th March 16:45

26th March 09:00

Updates added to (dates added to the question title):

25th March 19:45

24th March 07:30

23rd March 19:45

In progress FAQs:

We’re currently working on these questions (answers will be posted below and updated by WhatsApp):

Answered FAQs

Employers: Payroll & Furloughed Workers

Furlough updates following 29th May 2020 announcement

- The scheme will run until 31 October 2020

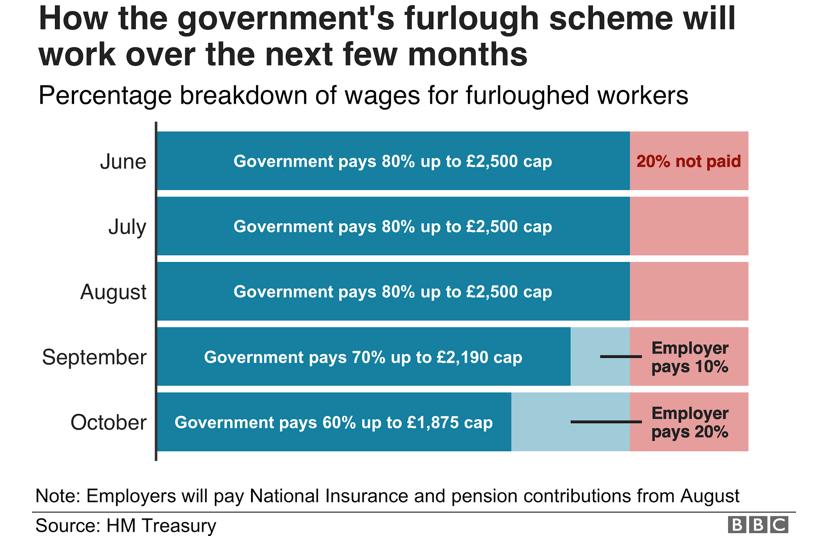

- From August employers will start to contribute (see table below for details)

- August employers pay National Insurance and Pension contributions

- September & October they pay the above, plus percentage of furloughed pay

- From 1st July you and your furloughed employees can work (this could be nothing, part time or full time).

- If you or any of your furloughed employees do work in a month, let us know the dates so we can adjust any furlough grant claims – you must keep track of these working hours/days

- Any work done by employees must be paid at their full contracted rate

- Full details to be published later this month

- Scheme not open to employees not yet furloughed after 30th June 2020

- Rumour that this means anyone needs to be on furlough by 10th June to be able to stay on furlough past 30th June (3 weeks) – not confirmed, but employees must be on furlough at 30th June

- No employees can join the scheme after 30th June

My company receives public sector funding for its operations. Can I put staff on furlough? (29th March 09:50)

HR specialists provide a Tool Kit to help put employees on Furlough - provided by Peninsula (26th March 16:45)

Shamelessly taken from an email I received today. Very useful and has links to the company in question (so it’s in their favour for us to copy and paste this info):

The Government announced on 20th March that any employer in the country – small or large, charitable or non-profit – will be eligible for the Coronavirus Job Retention Scheme if they Furlough their employees.

There is no need to wait until the Government issues further guidance on this scheme and you can Furlough your employees now.

All you are required to do is inform your employees that their employment status has been updated to Furlough. You should then follow this up with written correspondence via email attaching a letter, or by letter informing them of this change, which the HMRC may request and which will enable you to claim the grant.

We have created this draft letter for you to use which will allow you to Furlough your employees now.

Remember, you can access this letter and up to date information in your COVID-19 toolkit.

Kind regards,

Peter Done

CEO and founder

We took on a new employee in March 2020. Are they eligible for the 80% or is it based on how long someone has worked for you? (26th March)

Great questions. Unfortunately this is an employment law (HR) matter, so we suggest ringing our support line for advice on your specific circumstances.

Employment law support line details

Once there’s an answer, we’ll post it here for general information purposes only.

Update: 27th March – you still need to get legal advice on it, but we understand that the employee would not be eligible under your Payroll for furlough, as they did not work for you on the 28th Feb 2020. However if they had another job in Feb 2020, they can go back to the old employer and ask to be put back on the books and put on furlough.

How quickly will the funds be paid? I.e. if we cut wages from us, will he get paid by the Gov scheme next month or will it be a big delay? (26th March)

Ethically, if you have the funds you would cover this.

But hopefully HMRC can be having this new system working by end of April, however there are no guarantees.

A useful video clarifying much of our page updates from this morning (24th March)

Can you get your employer to give you 80%+ of salary? Inc zero hrs contacts, when home looking after kids, self isolating, just lost job etc. So many questions I've bashed out this rough video to explain.

Gepostet von Martin Lewis am Montag, 23. März 2020

What is a furloughed worker?

In short, they are a worker who is required to take unpaid leave, due to work shortages. They won’t work, they won’t get paid, but they are still employed.

Can I make any employee designated as furloughed?

It’s an employment law issue, so it does depend on their contract (as we understand it). It’s worth speaking to an HR advisor (we can recommend one or two) or seeking legal advice for clarity.

Update: 27th March 2020 – see the post above from 26th March about Peninsula – they list the process and are a good source for HR advice.

Government pledge to pay 80% of furloughed workers normal wage. What does this mean?

If you employee has been told there is no work for them, whilst the pandemic restrictions are in force, then they are furloughed. From the day you can no longer pay them (as they are not working), you’ll pay 80% of their normal salary (as current reading suggests). Once the government systems are set up, there will be a process of reclaiming this 80% salary from HMRC. So the employer is not out of pocket. The employer can choose to bridge the 20% shortfall, if they wish.

Update: 27th March 2020 – the employee must do no work for the company whilst they are furloughed. Nothing! Not even remotely.

Can an employee working reduced hours be furloughed and will I as an employer access the grant?

The current reading on this is not possible. If the worker is able to work, then they are not furloughed. Unpaid leave is the best way at looking if they are eligible (see above).

Update: 27th March 2020 – this is confirmed. Not possible to be working reduced hours and furloughed for the rest. Furlough means no work can be done by that employee.

What's the process?

We strongly recommend you get legal advice (or HR) on this, as this is very much an employment law issue.

This is all subject to change, but current reading is the following:

- Notify the workers that you are marking them as furloughed, rather than redundant or unpaid leave. You may need to keep some employees working, and send some home. It depends on how you work and how much work there is still to do.

- Pay will continue as normal for working employees. Furloughed will get 80% of their normal pay (see above as you can pay more). Once Gov systems in place, this 80% will be reclaimed from HMRC. Should start from end of April.

- Consider fairness. If one employee is being paid 80% of their salary to do nothing, but another is being paid 100% but working harder than usual. Some of the reimbursements from HMRC may need to be considered for bonuses etc on those still working??

- Get employment law advice

- We’ll help deal with the applications for reimbursement when we know more about the process.

Important reading on furloughed workers

Worth a read: https://app.croneri.co.uk/feature-articles/furlough-and-job-retention-scheme?product=132

Important extract from above :

Can I furlough employees who are on short-time working?

Furlough requires the employee to not carry out any work, so short-time working could not continue during furlough. However, consider whether you could re-organise reduced work patterns to allow for some of those on short-time working to go back to full hours and the others to be furloughed. You should discuss this with employees first.

Little information on this currently, but some useful quotes from various sources:

‘While it is not compulsory to use this scheme, it can serve as an alternative to a lay-off situation while helping both employees and workers to cover the many costs that are arising as a result of the outbreak. There are also no restrictions to be put into place; businesses of all shapes and sizes will be able to benefit from this.

With the rushed nature of the scheme announcement, inevitably there is limited information available and no technical guidance from HMRC as yet.

‘Some employers might find it frustrating that it rewards them for having half of their workforce not working at all when they would much rather have all of their workforce working half-time.

Sources:

https://www.accountancydaily.co/government-pay-80-salary-furloughed-workers

How does the job retention scheme work (Gov grant for 80% of workers affected by shutdown) - info from the Gov Site

All UK employers will be able to access support to continue paying part of their employees’ salary for those employees that would otherwise have been laid off during this crisis.

This is the crucial bit, as if your staff are still able to work, then this grant won’t be available (as we currently see it). It’s only if staff are not able to work due to the shutdown that this grant works.

To access, you will need to:

- Designate affected employees as ‘furloughed workers,’ and notify your employees of this change – changing the status of employees remains subject to existing employment law and, depending on the employment contract, may be subject to negotiation – we suggest getting HR advice on how to do this. Use our helpline if needed

- Submit information to HMRC about the employees that have been furloughed and their earnings through a new online portal (HMRC will set out further details on the information required) – we will do this or assist with this when the new portal is available

Message from HMRC:

HMRC will reimburse 80% of furloughed workers wage costs, up to a cap of £2,500 per month. HMRC are working urgently to set up a system for reimbursement. Existing systems are not set up to facilitate payments to employers. If your business needs short term cash flow support, you may be eligible for a Coronavirus Business Interruption Loan.

Updates:

Director only PAYE and Furlough

How do I put myself on Furlough? (30th March 13:30)

- You need to get agreement from your employees to designate them as furloughed workers and reduce their pay to 80%, capped at £2,500 per month – send them a letter (so you can email yourself the letter, copy hello@loveaccountancy.co.uk in too for a record) – use this template

- You can designate employees as a furloughed worker if they are PAYE and were on your books on 28th February 2020

- The scheme applies to all types of employee contract including full time, part time, zero hours and variable hours

- Once people recover after being on sick leave or in self-isolation, they can be furloughed

- Anyone made redundant from 28th February 2020 can agree to be brought back and placed on furlough

- Furlough must be for a minimum three weeks, but employees can be placed on furlough more than once

- Wages must be paid to employees first and then reclaimed through an online portal

This info is taken from an email from Peninsular – check out their tool kit here: http://go.peninsulagrouplimited.com/VyM50026DL0K000IBBKvac0

Can a director be a furloughed worker?

As at 27th March – Directors to claim through the Job Retention Scheme (if you can not work and you lose your revenue streams). Text from Government support pages:

If you’re a director of your own company and paid through PAYE you may be able to get support using the Job Retention Scheme.

However, if furloughed, the director can do no work for the company (other than statutory duties). They have to hit pause on their involvement in the business. If they work, they have to come off furlough.

What work can I do as a director under furlough?

You can’t do any work. However, you can continue with your statutory duties as a director.

What does this mean?

You can (open to interpretation):

- Review and sign all documents Love Accountancy send you for filing with Companies House and or HMRC. (Inc VAT returns, Company Accounts, Corporation Tax returns etc).

- Promote the company – maintain advertising

- Do your book keeping (if Love Accountancy do it for you, then your covered) – keeping up to date on accounts etc

- Chase debtors and pay suppliers/creditors

- Send out quotes for future work which you can do once the lockdown is over

You can’t (again open to interpretation):

- Do any paid work whilst on Furlough (i.e. raise new invoices for work done whilst on furlough)

HMRC and the Gov are likely to be very hot on this and may well check if directors are making claims. Remember, Xero logs your activity (around quotes and invoices).

What about Automated income?

- Automated income – without your input would seem to be OK – such as digital sales or automated bookings for future dates

There are two directors in my company. Can one work, whilst the other is on furlough?

Yes, this would be the best scenario, particularly if you have some work still to be done to meet order or keep customers on board, but there isn’t enough for both of you.

In theory, you could alternate between who’s on furlough and who isn’t on a month by month basis, but the admin on this might be considered too much.

Are my dividends covered under furlough?

No, only the PAYE element of your income. And the payroll must have been up and running by 28th February 2020 which a payment being made to the director on this date.

My company didn't have a payroll up and running on 28th February 2020, what can I do?

Freelancers (director only company) and Self Employed:

Retail or Businesses with premises (government grants):

Check you're registered for business rates (25th March)

If you rent a business property (office, retail or other unit), please check that you are registered for business rates, even if you don’t pay them due to reliefs. Just like council tax in a private residence letting, the tenant will register with the council, receive the payment letters (addressed to them) and make the payments.

Obviously where there are no rates to pay, some landlords have not insisted the tenant take this responsibility on. So please check.

If you’ve had letters in the past (addressed to your or your company) from the council, then you’re probably registered correctly. If not, check with your landlord, perhaps even call the council.

This is worth checking now.

Updates:

How do I claim the Government grants?

At the moment, the Government’s advice is that the local authorities will contact you about the grant.

We’re assuming this will be an automatic process and you won’t have to provide any financial information to support a claim. The claim is automatically awarded.

However we do think it worthwhile contacting your local authority to get clarity and keep chasing them: find my local authority/council

Keep an eye on these Government pages:

Updates: